Our website is made possible by displaying online advertisements to our visitors.

Please consider supporting us by disabling your ad blocker.

Capital Markets Union

| This article is part of a series on |

|

|---|

|

|

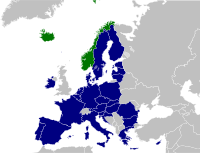

The Capital Markets Union (CMU) is an economic policy initiative launched by the former president of the European Commission, Jean-Claude Juncker in the initial exposition of his policy agenda on 15 July 2014.[1][2] The main target was to create a single market for capital in the whole territory of the EU by the end of 2019.[3] The reasoning behind the idea was to address the issue that corporate finance relies on debt (i.e. bank loans) and the fact that capital markets in Europe were not sufficiently integrated[4] so as to protect the EU and especially the Eurozone from future crisis. The Five Presidents Report of June 2015 proposed the CMU in order to complement the Banking union of the European Union and eventually finish the Economic and Monetary Union (EMU) project.[5] The CMU is supposed to attract 2000 billion dollars more on the European capital markets, on the long-term.[6][7]

The CMU was considered as the "New frontier of Europe's single market" by the Commission aiming at tackling the different problems surrounding capital markets in Europe such as: the reduction of market fragmentation, diversification of financial sources, cross-border capital flows with a special attention for Small and Medium-sized enterprises (SMEs).[8] The project was also seen as the final step for the completion of the Economic and Monetary Union as it was complementary to the Banking union of the European Union that had been the stage for intense legislative activity since its launching in 2012. The CMU project meant centralisation and delegation of powers at the supranational level with the field of macroeconomic governance and banking supervision being the most affected.[9]

In order to address the goals and the objectives decided at the creation of the project, an Action Plan subject to a mid-term review was proposed consisting in several priority actions along with legislative proposals to harmonise rules and non-legislative proposals aiming at ensuring good practices between market operators and financial firms.[10]

The new European Commission under the leadership of Ursula von der Leyen has committed to take ahead and finalise the project started by its predecessor by working on a new long-term strategy and to address the problems the project has had in recent times following the mid-term review and the UK's exit from the EU.[11] This is also highlighted in her bid for the presidency of the European Commission during the process of election as the main economic motto of her campaign was "An economy that works for people".[12]

- ^ "President Juncker's Political Guidelines". European Commission - European Commission. Archived from the original on 12 January 2021. Retrieved 23 March 2020.

- ^ Véron, Nicolas; Wolff, Guntram B. (2016). "Capital Markets Union: A Vision for the Long Term". Journal of Financial Regulation. 2 (1): 130–153. doi:10.1093/jfr/fjw006. hdl:10419/126699. ISSN 2053-4833.

- ^ "Press corner". European Commission - European Commission. Archived from the original on 21 June 2019. Retrieved 4 March 2020.

- ^ Lannoo, Karel; Thomadakis, Apostolos (2019). Rebranding Capital Markets Union: A market finance action plan (PDF) (Report). Centre for European Policy Studies. Archived (PDF) from the original on 1 August 2024. Retrieved 3 December 2024.

- ^ "The Five Presidents' Report". European Commission - European Commission. Archived from the original on 10 October 2020. Retrieved 5 March 2020.

- ^ Wright, William; Bax, Laurence (September 2016). "What do Capital Markets Look Like Post-Brexit?" (PDF). New Financial. Archived from the original (PDF) on 13 April 2017.

- ^ Guersent, Olivier (2 February 2017). "L'Union des marchés de capitaux : progrès réalisés et prochaines étapes" [The Capital Markets Union: progress and next steps]. Revue d'économie financière. 125 (1). Association d'économie financière: 137–150. doi:10.3917/ecofi.125.0137.

- ^ Quaglia, Lucia; Howarth, David; Liebe, Moritz (2016). "The Political Economy of European Capital Markets Union". JCMS: Journal of Common Market Studies. 54 (S1): 185–203. doi:10.1111/jcms.12429. hdl:10.1111/jcms.12429. ISSN 0021-9886.

- ^ Braun, Benjamin; Gabor, Daniela; Hübner, Marina (2018). "Governing through financial markets: Towards a critical political economy of Capital Markets Union". Competition & Change. 22 (2): 101–116. doi:10.1177/1024529418759476. hdl:21.11116/0000-0000-B1CB-3. ISSN 1024-5294.

- ^ Ringe, Wolf-Georg (2 January 2015). "Capital Markets Union for Europe: a commitment to the Single Market of 28". Law and Financial Markets Review. 9 (1): 5–7. doi:10.1080/17521440.2015.1032059. ISSN 1752-1440.

- ^ "The von der Leyen Commission's priorities for 2019-2024 - Think Tank". www.europarl.europa.eu. Archived from the original on 31 January 2020. Retrieved 22 March 2020.

- ^ "Political Guidelines for the Next European Commission 2019-2024: A Union that strives for more - My agenda for Europe". One Policy Place. 16 July 2019. Archived from the original on 22 March 2020. Retrieved 22 March 2020.

Previous Page Next Page