Our website is made possible by displaying online advertisements to our visitors.

Please consider supporting us by disabling your ad blocker.

Eurobond (eurozone)

Eurobonds or stability bonds were proposed government bonds to be issued in euros jointly by the European Union's 19 eurozone states. The idea was first raised by the Barroso European Commission in 2011 during the 2009–2012 European sovereign debt crisis. Eurobonds would be debt investments whereby an investor loans a certain amount of money, for a certain amount of time, with a certain interest rate, to the eurozone bloc altogether, which then forwards the money to individual governments. The proposal was floated again in 2020 as a potential response to the impacts of the COVID-19 pandemic in Europe, leading such debt issue to be dubbed "corona bonds".

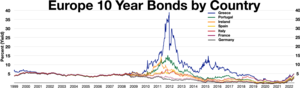

Eurobonds have been suggested as a way to tackle the 2009–2012 European debt crisis as the indebted states could borrow new funds at better conditions as they are supported by the rating of the non-crisis states. Because Eurobonds would allow already highly indebted states access to cheaper credit thanks to the strength of other eurozone economies, they are controversial, and may suffer from the free rider problem.[1] The proposal was generally favored by indebted governments such as Portugal, Greece, and Ireland, but encountered strong opposition, notably from Germany, the eurozone's strongest economy. The plan ultimately never moved forward in face of German and Dutch opposition; the crisis was ultimately resolved by the ECB's declaration in 2012 that it would do "whatever it takes" to stabilise the currency, rendering the Eurobond proposal moot.

- ^ "The euro zone crisis: Eurobonds: il conto, la cuenta, l'addition, die Rechnung". The Economist. 29 May 2012. Retrieved 13 November 2012.

Previous Page Next Page