Our website is made possible by displaying online advertisements to our visitors.

Please consider supporting us by disabling your ad blocker.

European Investment Fund

This article needs additional citations for verification. (January 2020) |

| |

| Type | International financial institution |

|---|---|

| Location | |

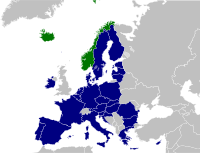

| Owner | EU member states |

| Website | www |

| This article is part of a series on |

|

|---|

|

|

The European Investment Fund (EIF), established in 1994, is a financial institution for the provision of finance to SMEs (small and medium-sized enterprises), headquartered in Luxembourg. It is part of the European Investment Bank Group.

It does not lend money to SMEs directly; rather it provides finance through private banks and funds. Its main operations are in the areas of venture capital and guaranteeing loans. Its shareholders are: the European Investment Bank (62%); the European Union, represented by the European Commission (29%); and 30 financial institutions (9%).[1]

The European Investment Bank Group is able to assist the development of a broader creative, green ecosystem through the European Investment Fund: venture capital funds, technical transfer, business perspectives, and private-sector equity (infrastructure funds) in general.[2][3]

Since 2015, the EaSI Guarantee Instrument (EU Programme for Employment and Social Innovation), managed by the European Investment Fund, has provided over €280 million in guarantees across Europe and is expected to provide over €3 billion in financing to micro-enterprises and social enterprises. In the coming years, the EIF intends to continue providing assistance to these types of final beneficiaries in areas heavily impacted by the transition to a low-carbon economy.[4]

The EIF is managed by a Chief Executive who acts independently in the EIF's best interests. As of 1 January 2023, the Chief Executive is Marjut Falkstedt.[5]

- ^ "EIF – Shareholders".

- ^ Bank, European Investment (14 December 2020). The EIB Group Climate Bank Roadmap 2021-2025. European Investment Bank. ISBN 978-92-861-4908-5.

- ^ "OTB Ventures launches new $60m fund to back European businesses at the next stage of growth". eif.org. Retrieved 12 October 2021.

- ^ "EaSI Guarantee Instrument". eif.org. Retrieved 18 October 2021.

- ^ "Senior Management". www.eif.org. Retrieved 5 February 2024.

Previous Page Next Page

صندوق الاستثمار الأوروبي Arabic Fons Europeu d'Inversions Catalan Evropský investiční fond Czech Europäischer Investitionsfonds German Fondo Europeo de Inversiones Spanish Euroopan investointirahasto Finnish Fonds européen d'investissement French Europski investicijski fond Croatian Fondo europeo per gli investimenti Italian 欧州投資基金 Japanese