Back توسيع منطقة اليورو Arabic Ampliación de la zona del euru AST Ampliació de la zona euro Catalan Přijetí eura Czech Διεύρυνση της ευρωζώνης Greek Ampliación de la eurozona Spanish Euroala laienemine ET Élargissement de la zone euro French Allargamento della zona euro Italian ევროზონის გაფართოება KA

The enlargement of the eurozone is an ongoing process within the European Union (EU). All member states of the European Union, except Denmark which negotiated an opt-out from the provisions, are obliged to adopt the euro as their sole currency once they meet the criteria, which include: complying with the debt and deficit criteria outlined by the Stability and Growth Pact, keeping inflation and long-term governmental interest rates below certain reference values, stabilising their currency's exchange rate versus the euro by participating in the European Exchange Rate Mechanism (ERM II), and ensuring that their national laws comply with the ECB statute, ESCB statute and articles 130+131 of the Treaty on the Functioning of the European Union. The obligation for EU member states to adopt the euro was first outlined by article 109.1j of the Maastricht Treaty of 1992, which became binding on all new member states by the terms of their treaties of accession.

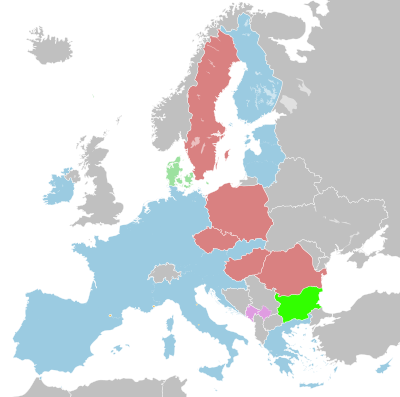

As of 2024[update], there are 20 EU member states in the eurozone, of which the first 11 (Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) introduced the euro on 1 January 1999 when it was electronic only. Greece joined 1 January 2001, one year before the physical euro coins and notes replaced the old national currencies in the eurozone. Subsequently, the following eight countries also joined the eurozone on 1 January in the mentioned year: Slovenia (2007), Cyprus (2008), Malta (2008), Slovakia (2009),[1] Estonia (2011),[2] Latvia (2014),[3] Lithuania (2015) and Croatia (2023).[4]

Six remaining states are bound by the EU treaties to introduce the euro once they fulfil certain economic criteria known as the convergence criteria — Bulgaria, Czech Republic, Hungary, Poland, Romania and Sweden — of which only Bulgaria currently participates in ERM II.[5] Since the convergence criteria requires participation in ERM II for a minimum of two years, and non-eurozone member states are responsible for deciding when to join ERM II, they can delay their compliance with the criteria by not joining ERM II.

All non-eurozone member states are assessed for compliance with the convergence criteria by the ECB and the European Commission biennially, with the most recent report published in June 2024. Member states can also request that their compliance be evaluated outside this two-year cycle as of any month of their choosing, as compliance is subject to change throughout the year.[6] Denmark has a treaty opt-out from the obligation to join the eurozone even if it complies with all criteria; historically this also applied to the United Kingdom, until it left the EU on 31 January 2020.

ECB began a 2‑year preparation phase for the creation of a new digital euro on 1 November 2023, which has been proposed - but not yet decided - to be introduced as an additional digital payment method coexisting with the currently available four types of euro transactions: cash, payment card, bank account, and other digital payments.[7] If the digital euro is adopted, it will be accessible and accepted as a new extra payment method for citizens in the eurozone, and also available for citizens of the European microstates subject to approval of revised monetary agreements. Any non‑eurozone member state will per article 18 of the proposed Council regulation also be granted the option to adopt the digital euro as a payment method for their citizens - without entering the eurozone, subject to the signing of a digital euro adoption agreement between the ECB and the national central bank of that member state.[8]

- ^ Kubosova, Lucia (5 May 2008). "Slovakia confirmed as ready for Euro". euobserver.com. Retrieved 25 January 2009.

- ^ "Ministers offer Estonia entry to eurozone January 1". France24.com. 8 June 2010. Retrieved 26 April 2011.

- ^ "Latvia becomes the 18th Member State to adopt the euro". European Commission. 31 December 2013. Retrieved 31 December 2013.

- ^ Wesel, Barbara (1 January 2023). "EU member Croatia joins the eurozone". Deutsche Welle. Retrieved 2 January 2023.

- ^ "Bulgaria, Croatia take vital step to joining euro". Reuters. 10 July 2020.

- ^ "Convergence Report". European Central Bank. 21 March 2022. Retrieved 2 March 2024.

- ^ "Eurosystem proceeds to next phase of digital euro project". European Central Bank. 18 October 2023. Retrieved 19 April 2024.

- ^ "Proposal for a Regulation of the European Parliament and of the Council on the establishment of the digital euro (COM/2023/369 final)". EUR-Lex. 28 June 2023. Retrieved 19 April 2024.