Back اعتماد مالي Arabic Akkreditiv AZ Акрэдытыў BE Акрэдытыў BE-X-OLD প্রত্যয়পত্র Bengali/Bangla Akreditiv BS Аккредитив BXR Akreditiv Czech Remburs Danish Akkreditiv German

| Part of a series on |

| Economics |

|---|

|

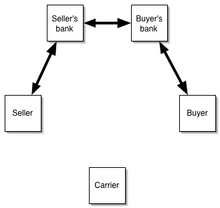

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.[1]

Typically, after a sales contract has been negotiated, and the buyer and seller have agreed that a letter of credit will be used as the method of payment, the applicant will contact a bank to ask for a letter of credit to be issued. Once the issuing bank has assessed the buyer's credit risk – i.e. that the applicant will be able to pay for the goods – it will issue the letter of credit, meaning that it will provide a promise to pay the seller upon presentation of certain documents. Once the beneficiary (the seller) receives the letter of credit, it will check the terms to ensure that it matches with the contract and will either arrange for shipment of the goods or ask for an amendment to the letter of credit so that it meets with the terms of the contract. The letter of credit is limited in terms of time, the validity of credit, the last date of shipment, and how late after shipment the documents may be presented to the nominated bank.[2]

Once the goods have been shipped, the beneficiary will present the requested documents to the nominated bank.[3] This bank will check the documents, and if they comply with the terms of the letter of credit, the issuing bank is bound to honor the terms of the letter of credit by paying the beneficiary.

If the documents do not comply with the terms of the letter of credit they are considered discrepant. At this point, the nominated bank will inform the beneficiary of the discrepancy and offer a number of options depending on the circumstances after consent of applicant. However, such a discrepancy must be more than trivial. Refusal cannot depend on anything other than reasonable examination of the documents themselves. The bank then must rely on the fact that there was, in fact, a material mistake.[3] A fact that if true would entitle the buyer to reject the items. A wrong date such as an early delivery date was held by English courts to not be a material mistake.[3] If the discrepancies are minor, it may be possible to present corrected documents to the bank to make the presentation compliant.[3] Failure of the bank to pay is grounds for a chose in action. Documents presented after the time limits mentioned in the credit, however, are considered discrepant.

If the corrected documents cannot be supplied in time, the documents may be forwarded directly to the issuing bank in trust; effectively in the hope that the applicant will accept the documents. Documents forwarded in trust remove the payment security of a letter of credit so this route must only be used as a last resort.

Some banks will offer to "Telex for approval" or similar. This is where the nominated bank holds the documents, but sends a message to the issuing bank asking if discrepancies are acceptable.[3] This is more secure than sending documents in trust.